Vea abajo para la traducción española.

Life in Venezuela is unimaginable to me for reasons beyond that I have never been there. I cannot picture walking into a store with no food on the shelves. I cannot comprehend walking around with massive bags of cash in the murder capital of the world. I cannot imagine how my entire life savings can suddenly being worth next to nothing. The list of the unimaginable when it comes to life in Venezuela could go on forever, however that is not the objective of this post.

There is a point where it becomes abundantly clear, that sharing articles on Facebook, posting a new profile picture in support of your favorite “cause” or donating a dollar at the grocery checkout register when the clerk asks if you’d like to support [insert cause here], just isn’t going to cut it.

I’m not a wealthy person, a politically-connected humanitarian-activist, or anything of the like. I’m a regular guy who, probably much like yourself, is sick and tired of sitting on the sidelines hoping socialist regimes will fall, or hoping world leaders will take action and better times will come to those in the most need.

So what SHOULD you do? I really don’t know. What I do know is that we each have our own unique talents and abilities, that when set to purpose, have the ability to make change far greater than we could ever imagine. My talent, is taking complex practices, and teaching them in a way that anyone with the desire, can learn, understand and apply.

What I’m going to teach in this post is how to send remittances to Venezuela with Bitcoin in order to circumvent the capital controls of a socialist regime. Laymen terms, I’m going to teach you how to send money to your family in Venezuela with limited fees or government interference, ensuring that a dollar sent is a dollar received. Guess what? Your loved ones in Venezuela can then leave the house in more safety, without a backpack full of cash, because the money is going straight to their bank account.

You might be wondering:

· What the hell is Bitcoin?

· How do I get it?

· And more importantly, how do I get it to my family?

The goal of this guide is to answer each of those questions, in simple terms.

Bitcoin is a digital currency which can be sent anywhere in the world as easily as sending an email. It is not controlled by the government or other central authority, but is rather controlled by its users. There is a limited supply of Bitcoin that will ever be in circulation; 21 million to be exact. This property makes Bitcoin rare. You can think of Bitcoin as digital gold, except unlike gold, Bitcoin is easily transferable anywhere in the world, and is not easily taxed or controlled by governing authorities.

Buying, selling and storing Bitcoin can be confusing for non-technical users; so let me break so you can actually DO what everyone is talking about. This post is here to help. If you are ready to take action then let’s get started.

The graphical representation below outlines each of the steps you will be taking in order to

1. Get Bitcoin for a fair price,

2. send it to your family in Venezuela,

3. They can take that Bitcoin and convert it to Bolivars

4. and finally, withdraw those Bolivars to their local bank account.

Take a look at the process flow below, and then follow along as I walk through the details of each step that is called out in the flow.

- Buying Bitcoin: Bitcoin is a digital currency which can be sent anywhere in the world as easily as sending an email. It is not controlled by the government or other central authority, but is rather controlled by its users. There is a limited supply of Bitcoin that will ever be in circulation; 21 million to be exact. This property makes Bitcoin rare. You can think of Bitcoin as digital gold, except unlike gold, Bitcoin is easily transferable anywhere in the world, and is not easily taxed or controlled by governing authorities. Buying, selling and storing Bitcoin can be confusing for non-technical users; so let me break it down. One of the most popular, my personal favorite sites to buy Bitcoin is www.coinbase.com, and is the site we will be referring to in the below images to walk through purchasing [1] and sending [2] from the process flow above. Alternatively, https://localbitcoins.com/ is a great site for direct person-to-person (P2P) trading of Bitcoin. You can even use https://coinatmradar.com/ to locate a Bitcoin ATM. Go ahead and create an account on Coinbase, and purchase the amount of Bitcoin you would like to send. Note: the website will show you the U.S. Dollar (USD) equivalent of Bitcoin you are purchasing. For a detailed guide to purchase your first Bitcoin, refer to this link: Coinbase Tutorial.

Comprar Bitcoin: Bitcoin es una moneda digital que puede ser enviada a cualquier parte del mundo tan fácilmente como enviar un correo electrónico. No está controlada por el gobierno u otra autoridad central, sino que está controlada por sus usuarios. Hay una oferta limitada de Bitcoin que estará en circulación; 21 millones para ser exactos. Esta propiedad hace Bitcoin raro. Se puede pensar en Bitcoin como oro digital, excepto a diferencia del oro, Bitcoin es fácilmente transferible en cualquier parte del mundo, y no es fácilmente imposible o controlado por las autoridades gubernamentales. Comprar, vender y almacenar Bitcoin puede ser confuso para usuarios no técnicos; Así que déjame romperlo. Uno de los sitios favoritos más populares para comprar Bitcoin es www.coinbase.com, y es el sitio al que nos referiremos en las imágenes de abajo para caminar a través de la compra [1] y el envío [2] del flujo de proceso anterior . Alternativamente, https://localbitcoins.com/ es un gran sitio para el intercambio directo de persona a persona (P2P) de Bitcoin. Usted puede incluso utilizar https://coinatmradar.com/ para localizar un ATM de Bitcoin. Adelante, cree una cuenta en Coinbase y compre la cantidad de Bitcoin que desea enviar. Nota: el sitio web le mostrará el equivalente en dólares estadounidenses (USD) de Bitcoin que está comprando. Para obtener una guía detallada para comprar su primer Bitcoin, consulte este enlace: Tutorial de Coinbase.

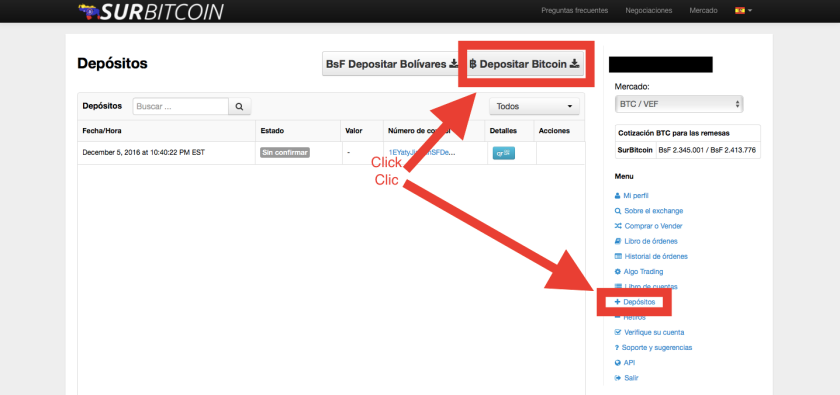

- Sending Bitcoin: Before you send the Bitcoin you have purchased to Venezuela, the person on the receiving end, will need to register on the surbitcoin exchange website. Once registered, they will need to verify their identity and link their bank account information. This is necessary in order to process withdrawals to their bank account. Once they have verified their identity and entered bank account information, they will need to navigate to the deposits page. Here they will click the deposit Bitcoin button and copy the address as shown below. This long alpha numeric string of digits is called their Bitcoin “address.” You can consider this their Bitcoin bank account number, and you will need their account number in order to send them the Bitcoin you purchased on Coinbase.

Enviando Bitcoin: Antes de enviar el Bitcoin que ha comprado a Venezuela, la persona en el extremo receptor, tendrá que registrarse en el sitio web de intercambio de surbitcoin. Una vez registrados, tendrán que verificar su identidad y vincular la información de su cuenta bancaria. Esto es necesario para procesar los retiros a su cuenta bancaria. Una vez que hayan verificado su identidad e ingresado la información de su cuenta bancaria, tendrán que navegar a la página de depósitos. Aquí se hace clic en el botón de depósito Bitcoin y copiar la dirección como se muestra a continuación. Esta larga cadena alfanumérica de dígitos se llama su “dirección Bitcoin”. Usted puede considerar este su número de cuenta bancaria de Bitcoin, y necesitará su número de cuenta para enviarles el Bitcoin que compró en Coinbase.

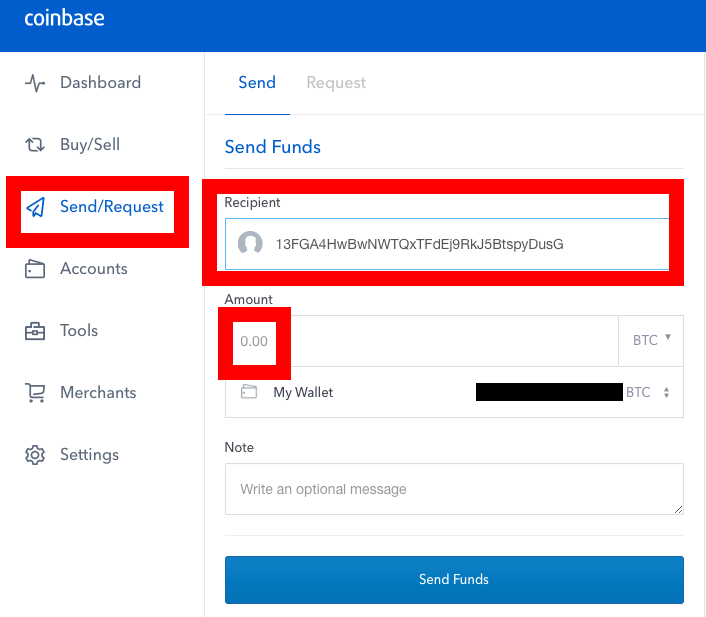

Once you receive their Bitcoin address (account number), you can navigate to the Send/Request menu on your Coinbase account and enter their Bitcoin address as the recipient as shown below. [It is advised that you copy and paste their address number for the step as it is easy to make a mistake typing in their address manually.] Once you have entered their address information, select the amount that you would like to send and press “send funds.”

Once you receive their Bitcoin address (account number), you can navigate to the Send/Request menu on your Coinbase account and enter their Bitcoin address as the recipient as shown below. [It is advised that you copy and paste their address number for the step as it is easy to make a mistake typing in their address manually.] Once you have entered their address information, select the amount that you would like to send and press “send funds.” Una vez que reciba su dirección de Bitcoin (número de cuenta), puede navegar hasta el menú Enviar / Solicitar en su cuenta de Coinbase e ingresar su dirección de Bitcoin como destinatario como se muestra a continuación. [Se aconseja que copie y pegue su número de dirección para el paso, ya que es fácil cometer un error escribiendo su dirección manualmente.] Una vez que haya ingresado su información de dirección, seleccione la cantidad que desea enviar y presione “enviar fondos”.

- Exchanging Bitcoin for Bolivars: Once you have sent Bitcoin from Coinbase to the recipient’s Surbitcoin wallet address, they will see the balance in their account after a short while [allow an hour]. Once the Bitcoin is available, they can sell the Bitcoin for Bolivars by clicking sell [as shown below]. Note: while it is generally not recommended to leave Bitcoin on exchanges for longer than is necessary, the fact that the Bolivar is inflating so rapidly, I would recommend only exchanging what is needed and holding the excess in Bitcoin. The reason for this while the Bolivar may be worth significantly less in one week than it is worth today, while Bitcoin is more likely to hold its value.

Intercambio de Bitcoin para Bolivars: Una vez que haya enviado Bitcoin de Coinbase a la dirección de la billetera Surbitcoin del destinatario, verán el saldo en su cuenta después de un corto tiempo [Permitir una hora]. Una vez que el Bitcoin está disponible, pueden vender el Bitcoin para Bolivars haciendo clic en vender [como se muestra a continuación]. Nota: aunque generalmente no se recomienda dejar Bitcoin en los intercambios por más tiempo de lo necesario, el hecho de que el Bolívar se infle tan rápidamente, yo recomendaría sólo el intercambio de lo que se necesita y mantener el exceso en Bitcoin. La razón de esto, mientras que el Bolívar puede valer significativamente menos en una semana de lo que vale hoy, mientras que Bitcoin es más probable que mantenga su valor.

Once the sell order has processed, they can click the withdrawal button and then select to withdrawal Bolivares as shown below.

Once the sell order has processed, they can click the withdrawal button and then select to withdrawal Bolivares as shown below.Una vez que la orden de venta se ha procesado, pueden hacer clic en el botón de retirada y luego seleccionar a los bolívares de retiro como se muestra a continuación.

- Once Bolivars are withdrawn as shown above, it will take about 24 hours for the Bolivars to show up in your local bank account.

Una vez que Bolívar sea retirado como se muestra arriba, tardará unas 24 horas para que los bolívares aparezcan en su cuenta bancaria local.

You are all done! In my next post, I’ll be discussing how to buy food, medical supplies, toiletries and more transacting with Bitcoin alone.

I hope this post makes a positive impact on someone you care about. If you have any questions about the process above, or want to chat, contact me at wesdewayne@gmail.com via email or g-chat, or leave a comment below.