With the Italian referendum approaching on December 4, 2016, global markets are heating up with trepidation and Bitcoin is once again in the limelight as a potential safe-haven asset.

The referendum, if passed would in effect put more power in the hands of the government by streamlining power of the Senate. Spearheading the referendum is Italian Prime Minister Matteo Renzi, who has publicly vowed to step down from office if the referendum is unsuccessful. On the flip side, the anti-establishment Five Star Movement (MS5) have used Renzi’s pledge as a conduit to campaign against the referendum and against Renzi himself.

What does this mean for Bitcoin?

If MS5 runs a successful campaign and Renzi steps down, the result would put MS5 in position to grab power and further their agenda; another referendum to leave the European Union and exit the Euro. If successful, this could cause a flood of investors exiting the Euro and into other currencies/assets with Bitcoin being a strong candidate.

We’ve seen numerous instances where such movement has happened, the recent Brexit being the most notable. During the Brexit referendum to leave the EU, we saw favored results to remain. It wasn’t until the last few hours of voting, upon which the votes switched to favor leave and shocked the markets.

| Votes | % | |

|---|---|---|

| Leave | 17,410,742 | 51.89% |

| Remain | 16,141,241 | 48.11% |

Prior to the vote, we saw the market had priced in a remain sentiment. Upon signal that leave was probable, the markets swiftly reacted, and the Euro and Pound plummeted, while Bitcoin and Gold flourished. Take a look at the charts below from the night of the Brexit vote, June 23, 2016.

EURUSD, 30

BTCUSD, 30

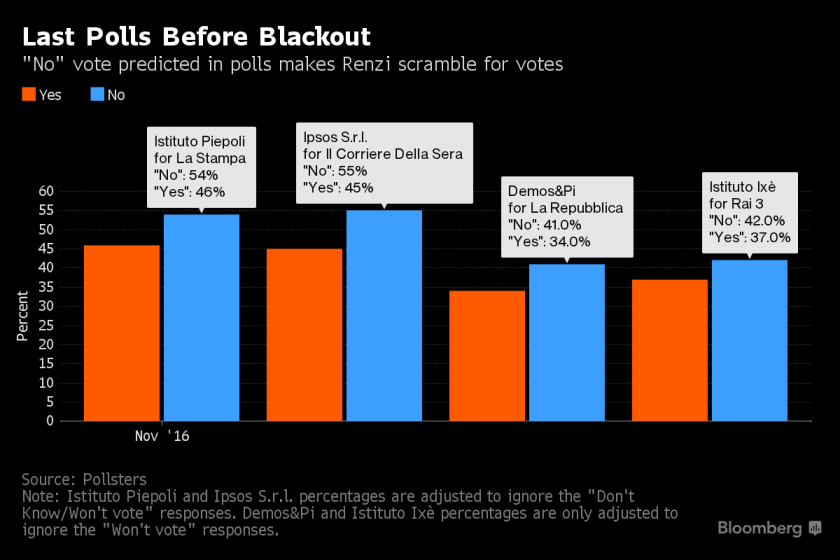

The Italian referendum is having similar effects to the markets, however contrast to the Brexit sentiment prior to the vote, the Italian referendum is favored to fail after the latest polling results from November, 18 as depicted below.

A quick look at the EURUSD, 60 chart shows markets have already priced in the sentiment of a “No” prevailing, and a potential future exit from the EU spearheaded by MS5 (note that other factors are playing into the fall of the Euro, including imminent interest rate hike by the FED, loose monetary stance in the Eurozone, etc.).

Conversely, we are already seeing a positive movement in the BTCUSD, 60 chart indicating a positive sentiment in Bitcoin partially stemming from uncertainty in the future state of the Euro.

Trading strategy:

With markets priced for a failure of the referendum and potential increase in power of MS5 and potential future exit of the EU and abandonment of the Euro by Italy (a lot of “if’s” here), traders should watch the polls carefully on Sunday and react accordingly. If the referendum fails as predicted, Bitcoin could see an even greater influx of demand, potentially pushing the price even higher than what has already been priced in by the market. Conversely, if the referendum passes, we could see money move out of Bitcoin, and a price depression as investors regain certainty in the Euro. Traders should watch carefully as much of the country is still undecided and the vote could swing either way.

If you have any questions on this strategy or just want to chat, feel free to contact me at wesdewayne@gmail.com via email or g-chat. For those who have asked, I do most of my trading on Whaleclub where you can use Bitcoin to trade stocks, forex, crypto, and commodities up to 100x leverage. Get a deposit bonus when you join via my referral link (and a nice bonus for me as well): https://whaleclub.co/join/ekOFIO

Happy trading!

Wes